In efforts to meet climate targets, the green energy carrier hydrogen is increasingly coming to the fore in the context of sector coupling. The basis for green hydrogen production is electricity from renewable energy plants. An electrolyzer is employed to produce hydrogen using green power and water. The process results in byproducts such as waste heat and oxygen which can also be utilized in various application areas and their sale can reduce the production costs of hydrogen. The option exists to convert hydrogen gas into synthetic natural gas and then into liquefied natural gas. This value chain is sometimes termed the power-to-gas or PtG value chain and allows for the distributed use of electricity in various sectors.

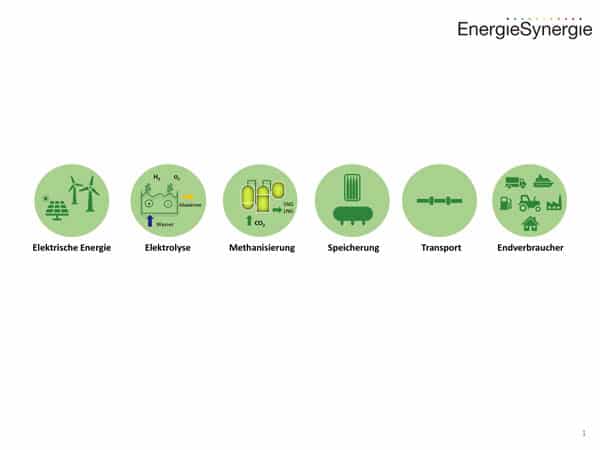

The following illustration shows the PtG value chain, from the use of electricity to produce hydrogen via the process of electrolysis, its conversion into synthetic natural gas or SNG and liquefied natural gas or LNG, followed by storage and transportation through to the use of green energy carriers by end users.

This PtG value chain (see fig. 1) can be viewed from two perspectives: On the one hand, the starting position is a defined quantity of generated green power that is available for electrolysis. On the other hand, there are the end users that specify how much hydrogen is needed.

In 2022, the H2-FEE research project was initiated, with the support of Niedersachsen’s business development bank N-Bank, to look at the overall scenario, from the end user through production. The project’s focus is on flexible energy carriers for the energy transition and Open WebGIS for the digital analysis of PtG potential in distributed energy sites, taking the German state of Niedersachsen as an example. The aim of H2-FEE is to develop a transparent platform to enable the identification of favorable and sustainable locations for hydrogen production based on renewable energy plants (both onshore wind power and photovoltaics), particularly in regions with high bioenergy density.

The project sheds light on specific PtG use cases for rural areas. These use cases include, for example, the increase in the level of self-sufficiency for office buildings, industrial enterprises or farms using seasonal hydrogen storage or the optimization of wind farms through the utilization of curtailed electricity in order to store available electrical power in the form of green energy carriers.

Here, profitability forms the basis for the development of these use cases. In connection with this, the authors carried out an analysis of studies on the electricity production cost for hydrogen, i.e., the levelized cost of hydrogen or LCOH, and future cost trends.

Imprecise LCOH forecasting

As part of this process, 12 studies on the LCOH of green hydrogen, published between 2010 and 2021, were analyzed. The forecast LCOHs vary considerably between studies due to the differences in calculation methods.

Some studies, for instance the “Hydrogen Rainbow” publication produced by the Institute for Climate Protection, Energy and Mobility IKEM, provide an overview of all hydrogen production processes and merely give an average price for each production method. [1] Other studies focus on only one particular element in the power-to-gas value chain, such as transportation or electrolysis, using one specific example. [2] [3] The publication “System comparison of storable energy carriers from renewable energies,” for instance, includes in its calculations all influencing factors, e.g., water costs and various electrolyzer technologies. [4]

The studies under consideration detailed the LCOH for the years 2014, 2015, 2020, 2021, 2030 and 2050. The studies only indicated average prices for the years 2014, 2020, 2021 and 2030 without further specifying the electrolyzer technology or other underlying conditions. Since for the years 2015 and 2050 most values (2015: 36, 2050: 47) are presented with comparable conditions, these are analyzed and compared in more detail as an illustration in the following sections.

Comparison of electrolysis types

The studies look at various electrolysis processes: electrolysis using proton exchange membrane or PEM, alkaline electrolysis or AEL, and high-temperature electrolysis or HTEL. These electrolysis processes are each at a different stage of development.

AEL is the oldest of the processes under investigation and has been in use for several decades. Indeed, of the processes studied, AEL is the most developed and has the lowest cost. [5] [6]

PEM electrolysis has existed for 25 years. One advantage of PEM electrolysis is its wider partial-load range. This technology copes well with the fluctuating feed-in of renewables to the electrolyzer. [5]

HTEL is still at the laboratory testing phase, which explains the cost of €24.41/kg in 2015. Furthermore, its early stage of development means that a cost prediction is associated with a high level of uncertainty. A price of around €6.60/kg is assumed for HTEL’s LCOH in 2050. [6] Because of the difficulty in forecasting development and the lack of data, the HTEL principle is not examined further in the following sections.

| Description | 2015 value | 2050 value |

| Water procurement costs | €2.0/m3 | €3.4/m3 |

| Electrolyzer full-load hours | 8,000 h per year | 8,000 h per year |

| Electricity production costs | 3.84 – 16.91 € cent/kWh | 0.69 – 15.71 € cent/kWh |

| Electrolyzer lifetime | 20 – 30 years | 30 years |

| Producer country for renewables | Germany, Iceland, Sweden, Saudi Arabia, Morocco | Europe and North Africa, Germany, Iceland, Sweden, Saudi Arabia, Morocco |

| Electrolyzer efficiency | 67{7bfcd0aebedba9ec56d5615176ab7cebc5409dfb82345290162ba6c44abf8bc8} | 69{7bfcd0aebedba9ec56d5615176ab7cebc5409dfb82345290162ba6c44abf8bc8} – 84{7bfcd0aebedba9ec56d5615176ab7cebc5409dfb82345290162ba6c44abf8bc8} |

In the various studies, different starting parameters are used as a basis in years 2015 and 2050. It becomes clear that there are a number of deviations in the starting parameters in the progression from 2015 to 2050. For example, water procurement costs rise from €2.0/m3 in 2015 to €3.4/m3 in 2050. The full-load hours of the electrolyzer are set at 8,000 hours for both comparison years. The electricity production costs fall from 3.84 € cent/kWh to 16.91 € cent/kWh in 2015 to between 0.69 € cent/kWh and 15.71 € cent/kWh in 2050.

The broad price range in terms of electricity production costs results from the different production locations and technologies involved in green electricity generation. While in northern Europe green electricity is primarily produced from wind power, the generation technology successively moves to photovoltaics or PV the further south that the producer country is located. For instance, the principal means of green power generation in the countries of Morocco and Saudi Arabia is photovoltaics. [7] The efficiency rises from 67 percent in 2015 to between 69 percent and 84 percent in 2050. The lifetime of the electrolyzers is extended from 20 – 30 years in 2015 to 30 years in 2050.

The median in 2015 for AEL is €5.59 kgH2 and is €5.28/kgH2 for PEM electrolysis. The mean values are €5.29/kgH2 for AEL and €5.28/kgH2.for PEM electrolysis. The spread of LCOH is larger for AEL than for PEM electrolysis as more data is available. The standard deviation from the mean is €1.70/kgH2 for AEL and €0.02/kgH2 for PEM electrolysis. Consequently, AEL has LCOHs that far exceed the level of PEM electrolysis as well as those that are well below it. Above all, the key factor here is the different electricity production cost in the various producer countries.

In 2015, the price spread for AEL ranges from €2.47/kgH2 to €8.59/kgH2. For PEM electrolysis it ranges only from €5.25/kgH2 to €5.30/kgH2.

Compared with 2015, a general decline in LCOH can be observed for 2050. The medians decrease to €4.18/kgH2 for AEL and to €4.65/kgH2 for PEM electrolysis. The means in 2050 are €4.14/kgH2 for AEL and €4.01/kgH2 for PEM electrolysis. Since there is more data available in 2050 compared with 2015 for the LCOH of PEM electrolyzers, the spread is likewise greater. A spread of values is also still in evidence for the LCOH of AEL. The deviations from the mean are €1.62/kgH2 for AEL and €0.94/kgH2 for PEM electrolyzers.

The forecast price range for LCOH for the year 2050 is between €1.26/kgH2 and €5.53/kgH2 for AEL, while the LCOH for PEM electrolysis is forecast to be between €2.87/kgH2 and €4.84/kgH2.

Comparison of LCOH in 2015 and 2050

Generally speaking, a decrease in LCOH is observable from 2015 to the forecast costs in 2050. One reason for this trend is the expansion in renewable energy which results in lower production costs for green electricity. [8] In addition, the progress and the scaling effect in electrolysis technology causes decreasing investment costs for electrolyzers. [9]

However, there are major differences in LCOH in the various years under consideration. This can be traced back to multiple causes.

The electricity production costs account for a significant proportion of the LCOH. Depending on the producer country, this brings about considerable differences. Nations such as Morocco and Saudi Arabia, thanks to their high levels of solar radiation, offer less expensive electricity from photovoltaic plants than in Germany. This pushes down the LCOH. In 2015, when the same AEL electrolysis process was considered in conjunction with the same PV energy source, the LCOH in Germany resulting from PV was €5.81/kg; in Morocco it was €4.28/kg. Although the general tendency is for hydrogen costs to decrease, this trend is also forecast for 2050, with an LCOH of €4.24/kg for PV from Germany and €3.43/kg for PV from Morocco. This does not take into account transportation to Germany. [4]

While the generation costs for renewables is falling, the costs for energy transportation are rising. The reason for this is the conversion/adaptation of the transmission grid to an environment based on renewables generation, involving greater demands on transmission grids and leading to higher transmission costs.

According to a 2020 study by the German Environment Agency, the costs for electricity, specifically three-phase current, are increasing from 2.4 € cent/kWh to 4.1 € cent/kWh. For production scenarios in which hydrogen is produced in Germany using imported power from renewables plants, the savings in the generation of electrical energy are offset by the cost increases in power transportation, meaning that the costs of electricity production remain virtually the same. [4]

Power-to-gas simulation

As becomes apparent from analyzing the LCOH in various studies, the LCOH is often founded upon a number of underlying conditions. This is why individual consideration is crucial for future PtG projects in order to make predictions about LCOH. A simulation can be a valuable tool in avoiding expensive investment errors. An example of a misinvestment would be choosing an electrolyzer with an excessive capacity rating that is then underutilized. The combination of low utilization and high investment drives up the LCOH.

The authors’ PtG simulation offers an ecological, financial and energy-based analysis of hydrogen production in combination with renewables plants (wind/PV/hydro/biomass). The PtG simulation analyzes, among other things, LCOH, quantities of hydrogen produced, byproducts (such as waste heat and oxygen), quantity of water required, rated capacity, and the utilization of the electrolyzer. Thus electrolyzer projects are able to be evaluated in financial and ecological terms.

Of two projects simulated by the authors from the year 2022, the LCOH was found to be €4.22/kg and €9.38/kg. These costs are underpinned by different electricity production costs: 3.8 € cent/kWh and 7.33 € cent/kWh.

A publication by the Institute of Energy Economics at the University of Cologne EWI specifies an average LCOH of green hydrogen for 2022 of €6.18/kg at an electricity production cost of 16.18 € cent/kWh. [10] This LCOH reflects the mean LCOH of €6.8/kg in the PtG simulations. Higher investment costs for the electrolyzer per kilowatt were assumed in the PtG simulations than the calculated average used by EWI.

Therefore what are the explanations for differences in LCOH?

Cost reduction through PtG simulation

It became clear through various simulations that a combination of wind and PV farms achieves a higher degree of utilization of the electrolyzer. A difference was also established in the utilization of the electrolyzer depending on whether the wind farms are located in coastal or inland areas.

This observation was made possible by performing calculations for three different scenarios:

- combined electricity procurement from wind and PV with a rated capacity of 12 megawatts (inland)

- electricity procurement of a coastal wind farm with a rated capacity of 12 megawatts

- electricity procurement of an inland wind farm with a rated capacity of 11.5 megawatts

This comparison was based on the same electricity production costs, water procurement costs and investment costs of the electrolyzer as well as the same service life in years of the electrolyzer. Only the plant types differ from one another, hence they also display different performance characteristics. In addition, each simulation was founded upon different wind years.

In all scenarios, a decline in utilization can be identified as the electrolyzer size increases. The smallest electrolyzer size examined was 250 kilowatts and gave utilization levels of between 91 percent and 93 percent for wind-only energy procurement and 95 percent for combined energy procurement from wind and PV. The largest electrolyzer size considered was 12 megawatts since this corresponded to the maximum capacity of the energy sources under investigation. In this case, the utilization levels were between 17 percent and 18 percent for wind-only energy procurement and 33 percent for combined energy procurement.

Furthermore, it becomes apparent that the utilization curve for the procurement of electricity from wind and PV sources is much higher than the utilization curves for wind power procurement alone. In the case of energy procurement from wind and PV, utilization is less pronounced and declines much more linearly than in the other two scenarios where a clear curve shape is discernible. This means that less energy is available to the same electrolyzer when electricity is sourced from wind alone and the utilization level recedes accordingly.

Using a combination of different renewable energy sources can balance out the natural fluctuations in the feed-in profiles of each particular energy source. The combination of different energy sources such as wind and PV thus ensures a higher level of electrolyzer utilization.

Figure 5 shows that the LCOH is far lower if wind and PV are used in combination than if wind power alone is fed in, since the utilization level is much higher, therefore enabling the electrolyzer in question to be used more to its full potential. The prices in this instance are approximately between €4.99/kg and €7.46/kg.

It is noticeable that the LCOH, for example for rated capacities of between around 2,200 kilowatts and 2,500 kilowatts, decreases slightly. The reason for this is the system consumption of the examined electrolyzers. System consumption indicates how many kilowatt-hours of electricity are needed to produce 1 standard cubic meter of hydrogen. If the next size up of electrolyzer then has a lower system consumption that means more hydrogen can be produced using the same amount of energy, and the LCOHs decrease despite a lower utilization level.

In this specific case, one electrolyzer with a capacity of 2,210 kilowatts has a system consumption of 5.3 kWh/Sm³ H2, while the next electrolyzer size up with a capacity of 2,500 kilowatts had a system consumption of 5 kWh/Sm³ H2. The reduced system consumption here has a greater effect on LCOH than the reduced utilization due to the additional 290 kilowatts in capacity. The correct selection of the electrolyzer therefore leads to a significant saving in terms of LCOH.

Although the scenarios under investigation are subject to similar conditions, there is significant variation in the LCOH that was calculated. For the same plant, the utilization and LCOH levels are indirectly proportional to each other. However, as soon as a comparison is made between various plants, a different price trend is observed. This underlines the need to investigate on a project-by-project basis.

Summary

Due to the variety of factors that influence LCOH, it is not possible to make a generalized statement about the trend in hydrogen prices. Prices from 2015 of €5.25/kg to €5.30/kg stand in contract to prices from the analyses from 2022 of €4.22/kg and €9.38/kg as well as the average LCOH calculated by EWI of €6.18/kg.

The analysis of LCOH studies revealed that there is a number of factors that affect LCOH. Important factors are:

- Type of electrolyzer and efficiency (or system consumption)

- Electricity production costs

- Electrolyzer utilization

- Electrolyzer investment costs

- Producer country for renewables

- Consideration of transportation costs

The combination of wind and PV leads to a higher level of electrolyzer utilization. Further influences on the LCOH are the different types of wind generation plant and their location.

Where the examined studies do agree is in the acceptance of trends such as the general reduction in LCOH in the run-up to 2050 due to falling electricity production costs and falling electrolyzer investment costs.

A detailed PtG simulation is able to demonstrate the potential for optimizing the implementation of a hydrogen project even at the early planning stage and makes it possible to avoid oversizing the electrolyzer, for instance, thus saving investment costs.

To summarize, LCOHs for specific projects are only predicable if all parameters are known. This is why it is not practical to draw general conclusions about the profitability of special PtG projects based on the forecast price trends of different studies.

Reference(s)

[1] P. Horng, M. Kalis, et al., IKEM, December 2020. www.ikem.de/wp-content/uploads/2021/01/IKEM_Kurzstudie_Wasserstoff_Farbenlehre.pdf

[2] P. Wienert, P. Stöver, et al., Production and transportation costs for green hydrogen from an offshore wind farm to an industrial end-user onshore, www.umlaut.com/uploads/documents/210812_Whitepaper_umlautKongstein_Hydrogen-ProductionTransportation.pdf

[3] DLR; LBST; et al., Studie über die Planung einer Demonstrationsanlage zur Wasserstoff-Kraftstoffgewinnung durch Elektrolyse mit Zwischenspeicherung in Salzkavernen unter Druck, Stuttgart, 2014

[4] A. Liebich, T. Fröhlich, et al., System comparison of storable energy carriers from renewable energies, German Environment Agency, https://www.umweltbundesamt.de/sites/default/files/medien/5750/publikationen/2021-03-03_texte_40-2021_syseet_eng.pdf

[5] B. Pitschak, J. Mergel, et al., “Elektrolyse-Verfahren,” in Wasserstoff und Brennstoffzelle, Berlin, Heidelberg, Springer Vieweg, 2017, pp. 207–227

[6] A. Liebich, T. Fröhlich, et al., German Environment Agency, https://www.umweltbundesamt.de/sites/default/files/medien/5750/publikationen/2021-03-03_texte_40-2021_syseet_eng.pdf

[7] Agora Energiewende and AFRY Management Consulting, No-regret hydrogen: charting early steps for H? infrastructure in Europe, https://static.agora-energiewende.de/fileadmin/Projekte/2021/2021_02_EU_H2Grid/A-EW_203_No-regret-hydrogen_WEB.pdf

[8] W. E. Council, Working Paper Hydrogen Demand and Cost Dynamics, World Energy Council, 2021

[9] Reiner Lemoine Institute, Netzdienliche Wasserstofferzeugung – Studie zum Nutzen kleiner, dezentraler Elektrolyseure, 2022

[10] Institute of Energy Economics at the University of Cologne EWI, E.ON, www.eon.com/de/wasserstoff/h2-bilanz/kosten.html

Authors:

Nele Uhlenwinkel, nele.uhlenwinkel@energiesynergie.de

Prof. Dr. Carsten Fichter, carsten.fichter@energiesynergie.de

Steve Stengel, steve.stengel@energiesynergie.de

All from EnergieSynergie GmbH, Bremerhaven, Germany